Below we will cover important tips and tactics to help you maximize your bodily injury settlement, including answers to frequently asked questions regarding Progressive car accident settlements.

Overview of Progressive Claims

Progressive is the third largest insurance company in the United States (by direct premiums written). We’ve all seen their ads featuring their well-known mascot, Flo, their fictional salesperson. Flo, like the GEICO gecko and Allstate mayhem character, is used by marketing companies to soften the image of insurance companies and to appeal to the general public using humor. Without that it would be almost impossible to market a product like insurance in a way that would be appealing to the masses.

The fact is the car insurance business is anything but humorous. It’s a business where massive amounts of money are collected from people with only a small part of it being paid out in claims. The large majority of this money is invested in the stock market and other investments. Insurance companies like Progressive make huge profits as a result.

Progressive serves a certain segment of the market just as GEICO does. It offers low-cost insurance to all types of drivers. Most of the policies sold by Progressive are on the low end. This is good and bad news. The good news is Progressive is more likely to pay their policy limits on a claim if, in their opinion, the damages justify doing so. The bad news is if you have serious injuries, it’s likely there won’t be enough insurance to cover all your damages.

Progressive’s Unfair Claims System

Progressive is known for being cheap. They will do everything they can to avoid paying fair value for a claim. How do they do it? First, they will deny liability on claims for a myriad of reasons. Even if they do accept fault for the accident, they will substantially discount the amount that they pay for your medical bills by using an internal arbitrary amount they consider “usual and customary.” Then, they will flat out reject paying some of your medical bills with the excuse that the treatment was unnecessary or excessive. Next, they will insult you further by paying only a fraction of your pain and suffering and other general damages (e.g., emotional distress, loss of enjoyment of life, etc.). Finally, they will fight you tooth and nail in litigation if you file a lawsuit against their insured.

Fight Progressive’s Unfair System with Knowledge

Don’t be a casualty to Progressive’s unfair claims system. Knowing your rights and being a well-informed claimant will help in leveling the playing field against this massive insurance company. The following 10 tips will help in overcoming Progressive’s unfair claims system:

1. Avoid Talking to Progressive

Limit your contact with Progressive as much as possible. Once their adjusters get you on the phone, be brief and try not to get cornered by their questions on the facts of the accident or your injuries. In fact, I would avoid talking to Progressive completely if they want a recorded statement. If Progressive is the at-fault party’s insurance company, there is no requirement that they take a recorded statement from you. If Progressive is your insurance company, you may need to give them a recorded statement. In either scenario, do not give a recorded statement to Progressive until you’ve consulted with a car accident lawyer.

2. Provide Evidence

Document the accident the best you can. This means gather as much evidence as possible just in case Progressive attempts to place some or all of the fault on you. This is very common in intersection accidents, left-hand turn accidents, and head-on collisions where there are no independent witnesses. Many times, Progressive will gamble and take the side of their insured even though there’s no clear evidence that would absolve their insured from liability.

Use Your Smartphone

Gather any evidence you can with one of the best tools we all carry everywhere we go—our smartphones. Use your camera and notes apps to document everything you can. Take pictures and videos of the vehicles involved, parties involved, driver’s licenses, license plates, insurance cards, road conditions, weather, traffic signs/lights, road debris, lighting, and any other physical piece of evidence you can that might be relevant.

Crash Report

A critical piece of evidence that you’ll want to get is the crash report. Either download a copy of the crash report online or pick up a copy from the appropriate police substation. A crash report is prepared by the officer that arrives on scene of an accident. Most of the time, if there are injuries or substantial property damage the officer must write a crash report.

What’s in a crash report? Well, it’ll have the who, what, where, when of the accident, including parties and witnesses’ names, time and place, and facts about how the accident occurred. In the report the officer may assign fault to one or both parties based on his/her opinion. This typically carries significant weight with Progressive and other insurance companies since the officer is not only an independent witness but can be considered an expert witness if your case goes to trial. Also, the crash report itself can come into evidence at trial but there will be certain parts of it that may not come in since they are considered hearsay evidence.

Independent Witnesses

Having an independent witness can be crucial to your case. An independent witness is someone who witnesses the accident with their own eyes or ears but doesn’t have any interest in the outcome. This will usually be another driver or pedestrian that witnessed the accident as it happened. In addition, a police officer that arrives on scene of an accident is also considered an independent witness, as mentioned above.

What isn’t an independent witness? That would be someone like a passenger in one of the vehicles involved in the crash or anyone that has a financial interest in the outcome of the case, including a spouse or family member of a party to the accident, even if they witnessed the accident themselves.

Event Data Recorder (EDR)

If your accident involved significant property damage and/or injuries and Progressive is denying liability, downloading the data from your Event Data Recorder may be useful.

What is an Event Data Recorder (EDR)? An EDR is a device installed in vehicles by auto manufacturers that record certain data before and during a crash. Most vehicles on the road have some version of an EDR. Federal law mandates that certain data be recorded by the EDR, including vehicle speed, acceleration, braking, airbag deployment, seat-belt status, and other important data.

You’ll need an expert such as an accident reconstruction expert to download and interpret the raw data from the EDR. This can be expensive. So, it may only be worth it if your crash was serious.

Keep in mind, if you intend to seek the other party’s EDR data, you’ll likely need a court order to access it and that usually requires a lawsuit be filed.

Security Camera / Residential Doorbell Camera Footage

If the accident occurred near a busy road or street where there are surrounding businesses with security cameras, it’s possible that one or more of those security cameras caught footage of the accident.

Additionally, if your accident occurred in direct view of a residential home equipped with a doorbell camera, it’s possible there may be footage that can help your case.

The challenge with both the security camera and doorbell camera footage is that it might be difficult to obtain from the owner. This footage is private property, and the business owner or homeowner doesn’t have to turn it over to you unless you get a court order. This may take time and the more time that passes, the greater chance that the footage will be erased.

If the accident was a hit-and-run or involved a serious injury or death, the police may be able to acquire this footage during their investigation. So, it’s important to follow up with the investigating officer and ask if they were able to find such footage.

Traffic Light Camera Footage

If you can actually access traffic light camera footage, do it. But accessing it may be more difficult than you think.

Most people think there are traffic cameras installed at most major intersections throughout their city. This isn’t true. There may be cameras on some traffic lights but most of the time these are only used for monitoring traffic flow and aren’t actually recording. There may be some cameras that do record but this footage may be difficult to access. You’ll need to go through the appropriate channels and fill out records request forms or need a court order, which takes time.

Dash Camera Footage

Nowadays, with the advancement of inexpensive technology such as a dash camera, many drivers now have these installed in their vehicles. As you can imagine, this footage can be invaluable when you’re involved in an accident where Progressive is denying liability.

Important note: don’t voluntarily provide this footage to Progressive or any insurance company unless you have to. They may try to interpret this footage against you by saying you took faulty evasive action or did something wrong that contributed to the accident.

Social Media Accounts / Cell Phone Records

If you’re fighting with Progressive over liability and think their insured was on their cellphone right before the accident, you may be able to get access to their social media accounts or cell phone records.

If their insured was texting or posting something on their social media account immediately before the accident, they can not only be found liable for the accident, but also liable for punitive damages. Punitive damages are awarded to an injured party when the at-fault party does something egregious, like texting and driving. These damages are awarded in addition to regular compensatory damages (e.g., medical expenses, lost wages, pain & suffering). They are intended to punish the at-fault party for their conduct.

Getting access to the Progressive driver’s social media accounts or cell phone records will almost always require a court order or that a lawsuit be filed. But you can always do your own investigating by searching their social media accounts and looking to see if they posted anything at around the time of the accident.

3. Mitigate Your Damages

Under the law, an injured party has a duty to mitigate their damages. What exactly does that mean? Mitigate means to make less severe. So, you have a duty to minimize the costs and damages associated with your accident. You can’t just sit back and let your injuries get worse or let your car sit at a storage lot and expect Progressive to pay for it all.

Failure to mitigate your damages is a common defense that Progressive uses in cases where the injured party fails to go to the doctor as soon as possible. They will argue that your injuries were made worse because of your own neglect.

The lesson here is to get medical treatment immediately and if your car was not drivable after the accident, make sure it’s parked somewhere it won’t accrue excessive storage fees. Also, if your car is totaled, don’t expect Progressive to pay for your rental car for an indefinite time. They will only usually provide a rental car for a few days after they’ve made an offer on your totaled vehicle. So, act fast when you think your car may be totaled and start shopping for another vehicle immediately.

4. Recover ALL Your Damages

Make sure Progressive is aware of ALL your damages that occurred as a result of your accident. Some claimants aren’t aware of all the recognizable damages that are recoverable under the law. These include:

Medical Expenses

Medical expenses such as your emergency room bill or pain medication prescription expenses are recognizable damages under the law. These are typically the largest part of most auto accident injury case’s damages. Not only is Progressive on the hook to pay your past medical expenses but they are also obligated to pay any medical treatment that is reasonably certain to occur in the future. Usually, you’ll need your doctor or a medical expert to provide proof that you will need future medical treatment.

Lost Wages / Lost Earning Capacity

A claim for lost wages is compensation for any missed time at work when you weren’t paid or had to use sick or vacation time. The best way to prove lost wages is to have your doctor write an excuse for you showing that you’ll need to miss work as a result of your injuries. You’ll also need proof from your employer that you missed work and what your rate of pay is. You can usually use pay stubs, tax returns, or bank statements for proof.

Lost earning capacity is compensation for severe injuries that cause permanent impairment to the point where the injured party will no longer be able to perform the job he/she did before. A claim for lost earning capacity will usually require an estimate from an expert such as an economist.

Physical Pain and Suffering

Most people are aware of this category of damages. But what exactly is it? Physical pain and suffering are the negative physical sensations experienced by an injured person. For example, it’s the stabbing, burning, throbbing, or aching felt by someone with a skin, bone, or soft tissue injury.

You can recover physical pain and suffering for the past and the future.

Mental / Emotional Distress

Mental or emotional distress damages compensates the injured party for the mental impact an injury has on their mind. This may include anxiety, depression, and Post-Traumatic Stress Syndrome. In most cases you’ll need a physical impact to claim mental or emotional distress. So, if only your vehicle was damaged and it stressed you out, you won’t qualify for mental or emotional distress.

You can also recover for mental or emotional distress in the past and the future.

Physical Impairment

You can recover compensation where your accident injured you to the point that you now have a permanent disability. A way to prove physical impairment damages would be to show Progressive that you can’t do the activities that you once did prior to the accident. For example, if you could no longer pick up your children due to your back injury, you may be able to qualify for physical impairment damages.

Scarring / Disfigurement

If you have scars, burns, or permanent marks on your body from your auto accident, you may be entitled to scaring or disfigurement damages. The best way to prove these types of damages is by providing Progressive with photos of your scars.

Loss of Enjoyment of Life

Loss of enjoyment of life damages compensates you for the loss of participation of life’s activities to the quality and extent normally enjoyed before the injury. You can recover for both past and future loss of enjoyment of life. An example of loss of enjoyment of life would be where the injury resulted in not being able to play with your children as you once did prior to the accident.

Loss of Consortium

Loss of consortium compensates your spouse or children for the loss of love, care, affection, companionship, and other pleasure of the relationship that may occur from your injuries. This category of damages is only for the spouses and children of accident victims. Proving these damages will usually require establishing that the relationship before the accident was stable and loving.

Punitive Damages

Punitive damages are intended to punish the at-fault party for their intentional, reckless, or grossly negligent conduct. Punitive damages are awarded in addition to compensatory damages. Compensatory damages are all the other previous types of damages discussed above. An example of where you may be able to get punitive damages is a case where a drunk driver caused your accident.

5. Prove Your Injuries are Severe

Progressive will place a larger value on your case if your injuries are more severe than, say, a soft tissue injury case (e.g., whiplash). Which injuries are more severe and worth more than a soft tissue injury case? Herniated discs, fractures/broken bones, traumatic brain injuries (even mild case), or tendon/ligament tears. All of these types of injuries usually require substantial medical treatment or surgery and therefore increase your medical damages and the value of your case. In addition, more serious injuries also drive the general damages portion of your case value since it is presumed that more serious injuries cause more pain and suffering.

So, how do you prove your injuries are severe? Your medical records, including MRI or X-Ray results is the best way. For example, if your MRI shows that you have a large, herniated disc (>3mm), that is causing moderate to severe spinal stenosis, that is proof that your injuries are severe and likely causing significant pain and suffering.

6. Discuss Your Case with a Lawyer

Discussing and hiring a car accident lawyer for your case is probably the best advice I can give to you. There are four main reasons why this is the case:

Free Advice

Personal injury attorneys all give free consultations. This means that no matter what you will get FREE advice from them even if you don’t end up hiring them. There is no downside. If you want to get their advice and try to settle your case on your own, you have that option.

They Only Get Paid If They Win

Personal injury attorneys always work on a contingency fee arrangement. That is, they only get paid if they are able to get you a settlement. So, they have an incentive to do the absolute best for you and get you the most money possible from the insurance company. Also, you don’t need to pay them anything out of pocket to start working on your case.

Your Case Will Be Worth More

When Progressive knows you don’t have a lawyer, they will assign the case to a low-level adjuster that only handles non-represented claimants. These adjusters are usually the least experienced and have very little settlement authority. They will try to settle your case for a nuisance amount. In other words, they will try to offer you $1,000 to $2,000 and pay for some of your initial medical treatment. But once you hire a lawyer, the case will be transferred to a more seasoned adjuster with more settlement authority. So, just by hiring a lawyer, your potential case value increases automatically.

And don’t forget that your attorney will build your case properly, present the best case possible to Progressive, and negotiate your case aggressively with the adjuster.

More Money in Your Pocket

Even though you’ll be paying a portion of your settlement to your lawyer, you will most likely end up with more money than you could if you handled the case on your own. There are studies that show that claimants that had an attorney handle their case received two to three times more of a settlement than those that handled their own case.

7. Be Familiar with Common Legal Doctrines

It’s not important for you to know the names of these legal doctrines but an understanding of these doctrines will help in your negotiations with Progressive.

Negligence

Car accidents are analyzed under the doctrine of Negligence. Most of us have an idea of the meaning of negligence. It seems relatively straight-forward. But under the law, it’s a bit more complex. Negligence is a whole body of tort law that deals with determining whether someone is liable for causing harm to another.

We’re only talking civil liability here, not criminal. More specifically, Negligence law deals with those acts that were not intended by the actor, but those that were done without using due care. The law uses a reasonable person standard to analyze whether someone should be liable for causing harm to another.

The plaintiff has the burden of proving that the defendant acted carelessly and as a result caused his/her damages. There are elements that the plaintiff will need to prove, including:

- Duty – We all owe a duty to each other not to cause harm to one another. For example, you should pay attention to the vehicle traveling in front of you so that you will have enough time to stop without rear ending them.

- Breach of Duty – The breach of duty occurs when the defendant fails to meet the reasonable person standard. For example, a breach would occur where you fail to pay attention to the vehicle in front of you and cause a rear-end accident.

- Causation – The breach of duty has to be the cause of the damages. There are two types of causation that need to be proved here:

- Cause-in-Fact – Was there a cause-and-effect relationship between the breach (i.e., not paying attention) and the damages (i.e., personal injury and property damage)?

- Proximate Cause – Was the harm foreseeable? In other words, are the damages caused by something that could be expected from the defendant’s carelessness? For example, were the injuries and damages to the rear-ended driver, let’s say whiplash and damage to the rear bumper, foreseeable when you failed to pay attention to the car in front of you?

- Damages – Damages are recognizable losses caused as a result of the defendant’s carelessness. These can be injuries, property damage, emotional distress, etc.

Why is knowing the doctrine of Negligence important in negotiating your case with Progressive? Knowing the concept can help you avoid having your case undervalued by the Progressive adjuster. Progressive is notorious for extending nuisance offers to claimants. They even had adjusters show up to the scene of the accident attempting to settle the case with the claimant. They know that in most cases (i.e., soft tissue injury cases), the bodily injury damages are nominal at that point. The claimant has not received any medical treatment, hasn’t been diagnosed with an injury, and hasn’t suffered any recognizable damages. Therefore, the claimant’s Negligence case is weak. This is the reason Progressive adjusters try so hard to settle your case immediately. They know if the case matures, and you hire an attorney, they will be paying an exponential amount on the claim.

Negligence Per Se

Negligence Per Se is a doctrine that says if the defendant that caused the accident also violated a statute, ordinance, or some other law, negligence is presumed. Depending on how Negligence Per Se is applied in your state, you may only need to prove Causation and Damages in your case. This makes it a lot easier to prove your case to the Progressive adjuster or to a jury if it ever gets to a jury trial.

Keep in mind that the statute or ordinance needs to be one that is intended to discourage the particular harm that was caused, and the defendant must not have an excuse for his failure to abide by the statute.

An example of Negligence Per Se is where a speeding driver causes a car accident. If the speeding driver was cited for driving 15 miles over the posted speed limit, he has violated a state law or city ordinance. The purpose of the speed limit statute or ordinance was to protect other drivers from harm caused by auto accidents. If there are no legal excuses for the speeding driver to be exceeding the speed limit, then he/she would be “per se” (Latin for in and of itself) negligent. In this case, if the speeding driver caused an accident that injured another driver, the injured driver would have a stronger case against the speeding driver.

Therefore, it’s crucial in your case against Progressive to download your crash report and see whether the at-fault driver was cited for a traffic violation when he/she caused your accident. If they were given a ticket for a traffic violation and caused the accident as a result, you need to stress that to the Progressive adjuster.

Eggshell Skull Plaintiff

The Eggshell Skull Plaintiff doctrine says that the defendant is responsible for making your delicate condition worse. If you have a preexisting condition or injury that is exasperated or aggravated by an auto accident caused by a careless driver, they are responsible for making it worse. This is true even if a normal person wouldn’t be affected by it.

An example of this would be where an elderly woman was severely injured in a very minor fender-bender accident where there is little visible damage to either car. But she sustained fractures due to Osteoporosis, her preexisting condition. It doesn’t matter that anyone else wouldn’t be injured to this degree. What matters is SHE was injured to this degree. The law says the defendant takes the plaintiff as he/she finds him.

If Progressive tries to use your preexisting condition or injury against you to say that your case isn’t worth as much, tell them you know about the Eggshell Skull Plaintiff rule.

Collateral Source Rule

The Collateral Source Rule says that if someone other than the one who causes your injuries pays your medical bills or you receive some other benefit from them, the at-fault party isn’t given a break in compensating you fully for your damages. This means if your health insurance company pays for your medical bills, the amount paid doesn’t reduce the amount the at-fault party is on the hook to pay.

The idea behind this rule is to not give the defendant a windfall in the event that the plaintiff, or someone acting on their behalf, was responsible enough to purchase health insurance.

Progressive may try to ignore this rule and minimize your case value if your health insurance or Medicaid/Medicare reduced or paid your medical bills. Don’t let them do this. Depending on your state, there may be exceptions or limitations to this rule. The best thing to do is talk to an attorney as soon as possible if Progressive tries to disregard the Collateral Source Rule.

Vicarious Liability

Vicarious liability places fault on someone other than the at-fault party due to a special relationship. The most common special relationship under vicarious liability is the employer-employee relationship. This is known as the Respondeat Superior doctrine. An employer is responsible for the negligent acts of their employees under certain circumstances.

Progressive is one of the largest commercial auto insurance carriers in the U.S. It is likely if you’re ever involved in an auto accident with a rideshare vehicle, van, box truck, or large truck, Progressive will be the commercial vehicle’s insurance carrier.

In Florida, another common type of vicarious liability is under the Dangerous Instrumentalities doctrine. This doctrine places fault on the owner of a vehicle when someone else is driving it and causes an accident.

Comparative Fault

If you’re partially to blame for your auto accident, it’s likely Progressive will reduce the amount of your recoverable damages. In some states like Florida and Texas, if you’re more than 50% at fault for your accident, you’re completely barred from recovering any of your damages. Other states like Arizona and California are more forgiving in that you can still technically recover some of your damages even if you’re 99% at fault.

8. Know How Preexisting Conditions Affect Your Case

As previously mentioned above, the Eggshell Skull Plaintiff rule enables recovery of an exasperated or aggravated preexisting injury or condition. Although this rule is well established common law, in practice there are two likely scenarios when you have a case with a preexisting injury or condition:

Preexisting Injury/Condition Helps You

Progressive may fully acknowledge the existence of the Eggshell Skull Plaintiff rule and apply it to your case. By doing so, they may accept all medical bills, lost wages, and pain and suffering damages on your case. However, this is a less likely scenario.

Preexisting Injury/Condition Hurts You

The most likely scenario is that Progressive will ignore the Eggshell Skull Plaintiff rule completely. They will argue that it is impossible to distinguish the preexisting injury or condition from the new injury. This is very common with spinal injuries, especially when the claimant is older. They will claim that the complaints of pain are all due to a degenerative condition (i.e., ageing) and not the accident itself. In essence, they are trying to rebut the third element of your Negligence case—Causation.

9. Know the Progressive Policy Limits

Progressive largely serves a market of folks that are looking for a bargain on their auto insurance rates. As a result, you end up with many Progressive policies sold with state minimums. Each state has different liability insurance limits requirements. Some are:

- Arizona

- Bodily Injury: $25,000 per person and $50,000 total per accident

- Property Damage: $15,000

- California

- Bodily Injury: $15,000 per person and $30,000 total per accident

- Property Damage: $5,000

- Florida

- Bodily Injury: Not required

- Personal Injury Protection: $10,000

- Property Damage: $10,000

- Texas

- Bodily Injury: $30,000 per person and $60,000 total per accident

- Property Damage: $25,000

In many cases, your compensation will be limited to the amount of the at-fault party’s insurance policy limits. Knowing the policy limits early in your case will be useful in figuring out how to proceed.

In most states, insurance companies are not required to disclose their policy limits in third-party claims. Some states, like Florida, do require it on written request. If you’re in a state where disclosure is not required, you can always request that Progressive ask their insured permission to disclose their policy limits. Sometimes this works. If not, it’s likely you’ll need to get an attorney involved to get this information.

If you have substantial medical bills and there’s a minimum policy, you may be better off immediately settling for policy limits instead of drawing out your case only to find out that you won’t be fully compensated for your medical bills, lost wages, and pain and suffering. Remember: money now is worth more than money in the future. Of course, always perform a thorough investigation on any potentially liable parties and check whether you have underinsured motorist coverage first before you settle with Progressive. Most underinsured motorist policies require permission from the underinsured carrier before you can settle with the at-fault party’s insurance company.

Another scenario where policy limits may affect your case is where there is a large Progressive insurance policy and you have minor injuries (e.g., whiplash). In these cases, Progressive may low-ball you since they aren’t worried about defending a case where, if presented to a jury, the risk of an excess verdict is unlikely. Insurance companies hate paying one penny above their policy limits. But if there is a very low chance that will happen if your case goes to trial, there is no pressure for them to settle.

10. Use Your Un/Under-insured Motorist Coverage

Uninsured Motorist Coverage

If Progressive denied your claim due to their insured’s policy lapsing or some other coverage issue, you may be able to recover your damages through your own insurance company. This will depend on whether you purchased uninsured motorist coverage or if you are a resident-relative to someone that has an active uninsured motorist policy.

When you use your uninsured motorist coverage, your insurance company steps into the shoes of the at-fault party. Even though you are dealing with your own insurance company in an uninsured motorist claim, don’t think they will be purely altruistic. It’s at this point your relationship with your insurance company becomes adversarial. You’ll want to use the same caution as you would with the at-fault party’s insurance company.

The good news is your own insurance company has certain duties under the law that the at-fault party’s insurance company doesn’t have. Number one: they must act in good faith in handling and resolving your claim. This is due to the fact that there is a contractual relationship with you and your insurance company; and in every contract, there is an implied duty of good faith. If they violate that duty, they could be subject to additional claims known as Bad Faith.

Underinsured Motorist Coverage

If the at-fault party’s Progressive policy limits are insufficient to cover your damages, you have some options. Hopefully, you’ve purchased underinsured motorist coverage. This is usually bundled with uninsured motorist coverage. This coverage provides additional protection in the event that you’re injured by a driver with insufficient insurance coverage. If you have an underinsured claim, your insurance company will also step into the shoes of the at-fault driver. So, again, don’t get too comfortable in dealing with your own insurance company in these types of cases. Your insurance company will also be subject to the same Bad Faith claims that are available in uninsured motorist claims, if they do not handle or resolve your claim fairly.

How Long Does It Take Progressive to Settle a Claim?

In our experience most cases with Progressive settle within six months. However, be aware that the length of time it will take for Progressive to settle a claim will depend on several factors, including:

Severity of Injury and Policy Limits

If your injuries were severe and the Progressive policy limits are low, you can likely settle your case quickly. Progressive doesn’t want to risk an excess verdict in this type of scenario. If your injuries are minor (i.e., soft tissue injuries) or the Progressive policy limits are large, Progressive will be less motivated to quickly settle your case for full value.

Pre-Litigation vs. Litigation

Cases usually settle faster before a lawsuit is filed, and usually a lawsuit is filed because the case couldn’t be resolved in pre-litigation. If a lawsuit is filed, your case may take some time to settle. Progressive attorneys may want to take your deposition and/or learn more about the strength of your case through written discovery in litigation. If you’re not able to settle your case before trial, you may need to wait all the way until your case is heard before a jury to get resolution. Depending on how crowded the court docket is your jurisdiction, litigation can sometimes take years.

Medical Treatment

You shouldn’t settle your case until you have been released from treating with your doctors or at least know the extent of any future medical expenses. If you settle your case prematurely, you can’t go back to Progressive and ask them for more money. Settlements are final.

Can Progressive Deny My Claim?

Yes, of course they can. The most common reasons for a denial are based on liability, coverage issues, or if your claim is categorized as a Minor-Impact-Soft-Tissue-Injury (M.I.S.T.) claim.

Liability Denial

If Progressive thinks that you were at fault for your accident, then they may deny liability on your claim altogether. In this case, they may not make any offers to settle your case at all. You will either need some good evidence or file a lawsuit in order to get them to change their position. See Tip #2 above for pointers on presenting evidence to Progressive.

Coverage Denial

Coverage denials can be for many different reasons. The most common of which are for either a lapse in coverage (e.g., insured didn’t pay their bill) or when the at-fault driver was not a permissive user (i.e., car was stolen). There may be ways around coverage issues, but you’ll likely need a lawyer to evaluate your own situation.

Minor-Impact-Soft-Tissue-Injury (M.I.S.T.)

M.I.S.T. cases are those where there is little visible property damage to the vehicles involved in the collision and the injuries are minor (e.g., whiplash). If your claim gets categorized as a M.I.S.T. case, Progressive will argue that there is no mechanism of injury and won’t pay for any of your injuries. These cases can be difficult and may require that you hire a lawyer. Litigating a M.I.S.T. case can be tricky since the costs to litigate may outweigh the benefits since you may need to pay experts such as a Biomedical Engineer to prove your case.

Is Progressive Good at Paying Claims?

Just like the rest of the large auto insurance companies, Progressive is not good at paying claims. Out of all the top five largest insurance companies in the U.S., I’d say they are not the worst and not the best. Nevertheless, they use similar tricks and tactics to avoid paying claims. As mentioned above, they will use a wide variety of excuses to either undervalue your claim or deny it outright. The best thing you can do is get the free advice of an experienced auto accident attorney.

Does Progressive Offer Low-Ball Settlements?

There is no question that they do. This is especially true with soft tissue injury cases. Low-ball offers is a common trick with all insurance companies. They know that a low-ball offer will discourage the average claimant from fully pursuing their case or even hiring a lawyer. Don’t let Progressive discourage you from receiving full compensation on your claim. Use as many of the tips in this article to deal with them and if that still doesn’t work, hire a lawyer.

Progressive Car Accident Settlements

Below are some our own Progressive auto accident case settlements and some pulled from Verdict Search, a database of jury verdicts and settlements.

Case Study #1: Client v. Progressive Insured (Volusia County, Florida)

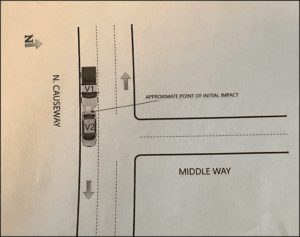

Client was traveling southbound on North Causeway near Middle Way in New Smyrna Beach, Florida, when she was rear ended by a Progressive insured.

The following day our client went to urgent care with complaints of headaches and back pain. Our client followed up with a chiropractor and was referred out for MRIs of her cervical and lumbar spine. The MRIs revealed bulges at C2-C3, C4-C5, C6-C7, L2-L3, and L3-L4 and disc herniations at C3-C4, C5-C6, and L4-L5. She was later referred to an orthopedic surgeon where she received epidural steroid injections and a medial branch radio-frequency ablation.

We later send a demand to Progressive for $300,000. Their first offer was $69,000. We later settled our client’s case for $125,000.

Case Study #2: Client v. Progressive Insured (Pinal County, Arizona)

Our client was driving his Chevrolet pickup westbound on Interstate 10, near mile post 217 in Picacho, Arizona, when he was rear-ended by a Progressive insured while traveling approximately 70 miles per hour. Due to the differing ride heights of each vehicle, the Progressive insured’s front end went under our client’s truck rear end. The impact from the Progressive insured’s vehicle caused our client’s vehicle to spin around 180 degrees, ultimately resting opposite of traffic, on the unpaved shoulder of the highway.

Our client’s airbags did not deploy, and his face struck a hard surface in his vehicle, causing significant facial injuries. He was then transported from the scene of the accident, by ambulance, to the emergency room. He sustained multiple serious injuries, including nasal bone fracture, septal hematoma, facial fractures, closed head injury, and an intracerebral hemorrhage. A CT scan of the Maxillofacial Area (face and jaw) was taken at the emergency room and the findings included displaced bilateral nasal bone fractures. On the right there was an extension of fracture into the nasolacrimal duct and minimally into the lamina papyracea (skull fracture). Also, there was a mildly comminuted nasal septum fracture.

Our client later presented to a plastic surgeon for evaluation and discussion on his facial injuries’ treatment options. The doctor ordered surgery on our client’s facial injuries, including a closed reduction of the nasal bone and nasal septal fracture.

We demanded Progressive pay their policy limits immediately and they tendered their $15,000 policy limits. Due to the insufficiency of the Progressive insurance policy, we sought recovery from our client’s underinsured motorist policy. We settled with his underinsured carrier for $60,000, for a total settlement amount of $75,000.

Case Study #3: Clients v. Progressive Insured (Travis County, Texas)

Our clients were traveling in the rear seat of a rideshare vehicle heading westbound on East Braker Lane toward the I-35 service road intersection when a Progressive insured turned left in front of their vehicle causing a collision. The Progressive insured then proceeded to flee from the scene of the accident. The police later caught him, and he was cited for failure to stop and render aid.

Both of our clients presented to the emergency room three days after the accident. Client #1 complained of chest wall and left shoulder pain. He then later presented to a chiropractor for treatment of his injuries. He was later referred out for an MRI of the cervical spine and left-sided brachial plexus. The radiologist noted a 1mm disc bulge at C5-C6 and C6-C7, as well as a subtle fracture in the left upper sternum. Due to persisting pain in his neck, he was referred out to a pain doctor where he received a cervical epidural steroid injection.

Client #2 complained of pain in her hips and right lower leg. She followed up with a chiropractor and received an MRI of her pelvis and X-Ray of her lumbar spine. The radiologist noted soft tissue edema in the right buttock region and a potential labral tear.

We sent demands for policy limits for both clients and received initial offers of policy limits of $30,007 for Client #1 and $12,900 for Client #2. We later settled Client #2’s case with Progressive for $17,000. Client #1 received a total of $67,500 in settlements, including underinsured motorist benefits and Personal Injury Protection from his own carrier. Client #2 received a total of $19,500, including $2,500 in Personal Injury Protection from her own carrier.

Case Study #4: Client v. Progressive Insured (Hood County, Texas)

As our client was entering her vehicle in a hospital parking lot in Granbury, Texas, a Progressive insured rear-ended her vehicle. As a result, she hit her head against the A-pillar of her vehicle.

Our client then immediately presented to the emergency room with complaints of headache and neck pain. She was given pain medication and discharged later that night.

She then presented to a chiropractor the next day for her headaches and neck pain. The chiropractor referred her out for MRIs of her brain, and cervical and lumbar spine. The radiologist noted minimal spondylosis in her neck and an aneurysm in her brain. As a result of her severe headaches and the positive finding of her brain MRI, she was rushed to the emergency room by Life Flight.

We immediately sent Progressive a demand for policy limits. They quickly responded by tendering their policy limits of $50,055.

Case Study #5: Clients v. Progressive Insured (Fort Bend County, Texas)

Our clients, a mother with her two young children, all pedestrians, were crossing the street in a residential area of Sugar Land, Texas. A Progressive insured was traveling northbound in her SUV and was stopped at the stop sign. As our clients attempted to cross the street in the crosswalk, the Progressive insured failed to yield the right of way to our clients, striking one of the children, causing her to fall to the concrete and hit her head. Police arrived at the scene, statements were taken, including a statement from the Progressive insured stating that she was being distracted by her phone at the time of the accident.

Immediately from the scene of the accident, our client was rushed to the emergency room by ambulance. She presented to the emergency room doctor with complaints of head trauma and injuries to her face, hips, thighs, and extremities. The doctor ordered the following imaging to be performed, including CT scan of the brain, chest X-Ray, abdomen/pelvis CT scan, facial bones CT scan, X-Ray of the right foot, X-Ray of the left humerus, X-Ray of pelvis, CT scan of the cervical spine, and X-Ray of the tibia fibula. The diagnosis included facial contusion, hematoma of the scalp, multiple contusions, musculoskeletal pain, and nasal swelling. Upon release, instructions were given to follow up with pediatric surgery within one week, to follow up with a primary care provider within three to five days, and to return to the emergency department if needed.

Days later, due to swelling and bruising of our client’s nose and the worsening of her head contusion, she presented to the emergency room. Facial bones CT scans were ordered. Abnormalities were discovered and the doctor prescribed antibiotics to treat the swelling. The emergency room doctor instructed our client’s parents to follow up with a pediatric ENT as soon as possible.

Our client later presented to a pediatric ENT complaining of a possible broken nose due to significant bruising and swelling. The ENT evaluated our client’s nasal injury, ordered an X-Ray for further treatment, and prescribed medication to help reduce swelling.

Subsequently, our client presented to a pediatric neurologist seeking an evaluation of the abnormal bump on her head. She had been experiencing neurological irregularities including movements of the face. In addition, she complained of headaches for the first month after the accident. The neurologist ordered an MRI of the brain and prescribed medication to alleviate her symptoms.

We later sent Progressive a demand for their policy limits of $250,000. Their first offer was $108,000. We then proceeded to file a lawsuit against their insured. We ultimately settled our client’s case for $220,000.

Case Study #6: Client v. Progressive (Harris County, Texas)

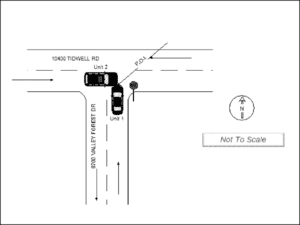

Our client, a ride-share driver, was traveling eastbound on Tidwell Road in Houston, Texas, when an Allstate insured ran a stop sign and t-boned her on the front right fender of her vehicle. Houston Police arrived on the scene and determined the Allstate insured was at fault for the accident.

Four days later, our client presented to a chiropractor complaining of extreme pain in her left shoulder, and back and neck pain. Due to her persistent pain, our client was referred out for MRIs of her shoulder, cervical spine, and lumbar spine. The radiologist noted a high-grade partial tear of the supraspinatus tendon in her left shoulder. She was later referred out to an orthopedic for an evaluation on her torn tendon. The orthopedic surgeon recommended arthroscopy surgery to repair the tendon. Our client proceeded with the surgery.

We sent a demand to Allstate for their policy limits of $30,000, which they tendered. We sought underinsured motorist benefits from our client’s insurance carrier, Progressive. We demanded her policy limits of $60,000, which they later tendered. In total our client received $93,615.07 in total settlement funds, which included $3,615.07 in lost ride-share revenue.

Case Study #7: Plaintiff v. Defendant (Kern County, California)

Plaintiff, while riding her bike in a crosswalk, in Bakersfield, California, was struck by defendant, and thrown on her hood, later falling onto the street. Her injuries included pelvic fracture, rib cage contusions, leg contusions, and neck and shoulder sprains.

Plaintiff was transported to the emergency room by ambulance. She later underwent 12 weeks of physical therapy, as well as several lumbar epidural steroid injections.

She later settled with Progressive for $95,000 of their $100,000 policy limits prior to trial.

Case Study #8: Plaintiff v. Defendant (Orange County, California)

Plaintiff was driving eastbound through the intersection of Alton Parkway and Armstrong Avenue in Irvine, California, when defendant made a left-hand turn in front of her, causing the collision.

Plaintiff was rushed to the hospital from the scene of the accident by ambulance. She suffered nose and eye socket fractures, as well as abrasions to her face, elbow, and knee. She underwent surgery to repair her orbital floor and nasal fracture.

Progressive later tendered their policy limits of $250,000.

Case Study #9: Plaintiff v. Defendant (Santa Clara County, California)

Plaintiff was driving her vehicle southbound on San Antonio Road in Santa Clara, California, when she was T-boned on the left side by the defendant while she ran a stop sign.

The plaintiff presented to the hospital after the accident and was diagnosed with traumatic ulnar nerve damage to her right (dominant) wrist. She missed two weeks of work suffered with loss of enjoyment of life from the injury.

Plaintiff sued the defendant and following an arbitration hearing, Progressive agreed to settle her case for their policy limits of $50,000.

Case Study #10: Plaintiff v. Defendant (Los Angeles County, California)

Plaintiff, a pedestrian, was struck by a vehicle driven by Defendant as he had veered onto the sidewalk on Elm Street in Los Angeles, California. Plaintiff was taken to a hospital, where he later died.

Defendant attempted to flee the scene of the accident but was later captured by police. He had a .20 blood alcohol level. He also had prior felony D.U.I convictions.

The case later settled for $1,000,000, $250,000 of which was paid by Progressive, their policy limits.

Progressive Contact Information

Website: https://www.progressive.com/

Claims: 800-776-4737

Progressive Campus Locations: https://www.progressive.com/locations/

Claims Locations: https://www.progressive.com/careers/locations/claims-offices/

Contact Our Experienced Car Accident Lawyers to Handle Your Progressive Claim

Call us today for a FREE consultation regarding your Progressive bodily injury claim. Our car accident injury lawyers can investigate your accident, determine the at-fault party, and help you present the best case possible to Progressive. Call (855) 545-1777 to speak to our personal injury attorneys directly.